A consumer trend that has taken the food industry by storm is a more health-conscious customer, no longer consuming for taste, but for holistic nutrition. According to research, the global market for organic foods will be worth $323 billion by 2024, with more than 60 percent of consumers attributing “healthfulness” as an influencing deciding purchasing factor (Afable). It is important to note, the yearning for holistic health, meaning the attention to the mental, physical, and emotional health, are important sociocultural changes that influence existing company decisions and give opportunities for new companies to enter the market. More and more consumers are making purchasing decisions based on what they believe would make them feel better (Bold Business). As the Executive Vice President and Practice Leader for Client Insights at Information Resources Inc., Ms. Wyatt says, “Brands and retailers can stay one step ahead of the competition by providing consumers with a seamless shopping experience that supports their holistic health goals.”

Aldi U.S. is part of a privately owned German company, Aldi Sud, which opened its first U.S. stores in 1976, known for low prices and award-winning private label foods and beverages with a “keep it simple” motto. Aldi Sud has been widely successful in its home country and has decided to expand and update its stores in the United States, spending $5.3 billion to remodel its existing 1,800-plus stores and open 800 new ones as part of their 5 year plan. The company is focused on offering foods that are more convenient for the shopper and hope to become the third largest grocer in the United States by the end of their plan, which will put them behind Walmart and Kroger (Lempert). As part of their growth strategy, Aldi has expanded their fresh food offerings by 40% in hopes to capture the growing health-conscious consumer.

The United States organic food market has grown with more and more people pursuing organic food options with simple ingredient lists, no artificial add-ons, and gluten-free options. A trend that has arisen from the health-conscious consumer has been the Free From offering, which consists of food options that are free from dairy, lactose, allergens, and gluten. In addition, the global consumer is wanting not only organic, but also health functionality in their food options like probiotics, omegas, and vitamins. As of 2017, the food functionality offerings is valued at $247 billion dollars (Mascaraque).

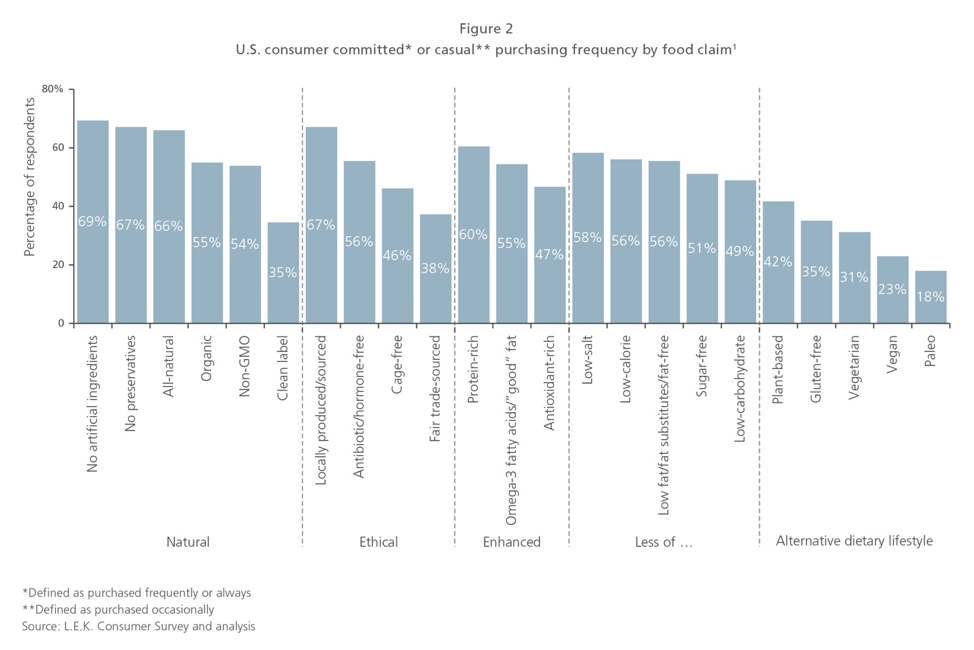

Study shows that 41% of Generation Z and 32% of Millennials would pay a premium for sustainably sourced ingredients, which has led to the rise of health-centered companies, concentrating on organic locally sourced food options to capture the growing market (Ganev). There is also a commitment from the consumer to at least one health, wellness, ethical or environmental attribute among the foods they eat and are willing to pay for food that delivers on their claims (Steingoltz).

In reaction, Aldi has offered and plans to enhance their exclusive brands: SimplyNature, Earth Grown, Specially Selected, Never Any!, LiveGFree (live gluten free). Offerings include their “fresh never frozen” seafood, organic meats, a Never Any! brand of chicken, which does not have any antibiotics, hormones, animal by-products, steroids or salt and are fed a 100% vegetarian diet. They also offer Earth Grown kale veggie burgers (Lempert). Aware of the changing consumer buying behavior, Aldi’s innovations in fresh, organic, and trendy offerings has been capturing the health-conscious consumer. Aldi’s organic produce sales have increased by over 200 percent in the last three years and they continue to add to its private label gluten-free products (Reagan).

Aldi also reformulated and removed more than 125 ingredients in its SimplyNature products back in 2015 to meet the needs of shoppers who want simple and few ingredients while still providing a healthy and natural food offering (Lempert). With Aldi really pushing towards a simple yet healthy plan, it will be interesting to see how Walmart and Kroger will measure up in 2022, especially as holistic health trends does not seem to be slowing down any time soon.

https://commetric.com/2019/01/04/fast-food-in-the-media-the-rise-of-the-health-conscious-consumer/

https://www.lek.com/insights/ei/next-generation-mindful-food-consumption